Cybersecurity researchers have discovered an updated version of an Android banking malware called Chameleon that has expanded its targeting to include users in the U.K. and Italy.

“Representing a restructured and enhanced iteration of its predecessor, this evolved Chameleon variant excels in executing Device Takeover (DTO) using the accessibility service, all while expanding its targeted region,” Dutch mobile security firm ThreatFabric said in a report shared with The Hacker News.

Chameleon was previously documented by Cyble in April 2023, noting that it had been used to single out users in Australia and Poland since at least January. Like other banking malware, it’s known to abuse its permissions to Android’s accessibility service to harvest sensitive data and conduct overlay attacks.

The latest findings from ThreatFabric show that the banking trojan is now being delivered via Zombinder, an off-the-shelf dropper-as-a-service (DaaS) that’s sold to other threat actors and which can be used to “bind” malicious payloads to legitimate apps.

“Upon receiving confirmation of Android 13 Restricted Settings being present on the infected device, the banking trojan initiates the loading of an HTML page,” ThreatFabric explained. “The page is guiding users through a manual step-by-step process to enable the accessibility service on Android 13 and higher.”

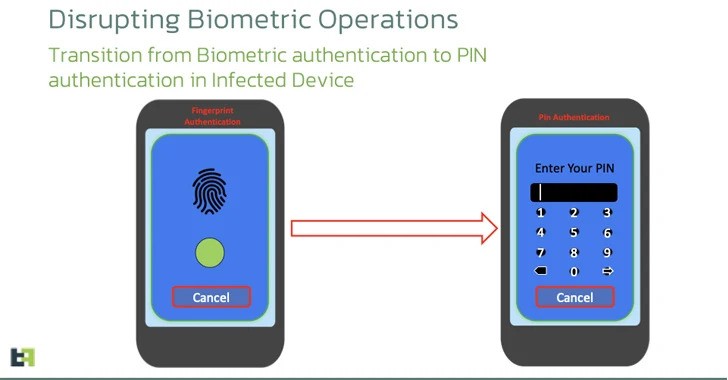

Another new addition is the use of Android APIs to disrupt the biometric operations of the targeted device by covertly transitioning the lock screen authentication mechanism to a PIN so as to allow the malware to “unlock the device at will” using the accessibility service.

The U.S. top countries targeted comprise the U.S. (109 bank apps), the U.K. (48), Italy (44), Australia (34), Turkey (32), France (30), Spain (29), Portugal (27), Germany (23), Canada (17), and Brazil (11). The most targeted financial services apps are PhonePe (India), WeChat, Bank of America, Well Fargo, (U.S.), Binance (Malta), Barclays (U.K.), QNB Finansbank (Turkey), and CaixaBank (Spain).

“Traditional banking applications remain the prime target, with a staggering 1103 apps – accounting for 61% of the targets – while the emerging FinTech and Trading apps are now in the crosshairs, making up the remaining 39%,” the company said.

Source: https://thehackernews.com/